Take a look at this balance sheet excerpt below to understand the placement and treatment of non-current assets in financial reporting. Suppose there is a company which has equipment and machinery worth ₹100 crores and depreciation to date is ₹10 crores. Their goodwill value is ₹ 15 crores, rights and patents worth ₹ 20 crores and the natural resources they use worth ₹1000 crores.

A company’s tangible assets are its property or assets with a physical form that is essential to its core business operations. A tangible asset’s recorded value equals its initial acquisition cost minus any accumulated depreciation. Contrarily, non-current assets are always listed on the balance sheet under one of the following categories – investments, intangible assets, property, plant and equipment, or other assets.

A big part of that is understanding the differences between current and non-current assets, the roles they play in your business, and how to manage them. Noncurrent assets contribute to a company’s earning capacity but they do not affect liquidity in the short-term. They can’t be quickly converted to cash for meeting short-term obligations. It generates when the price that is paid for the company goes over the fair value of all of the identifiable assets and liabilities.

No-Shop Clause: Meaning, Examples and Exceptions

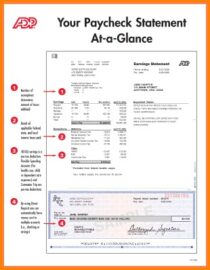

Similar to the accounting for assets, liabilities are classified based on the time frame in which the liabilities are expected to be settled. Goodwill is for intangible assets such as company reputation and adp totalsource software brand name. An indefinite intangible asset remains for as long as the company is in business. Whereas a definite intangible asset only stays with the company for the duration of a contract or an agreement.

P&G Announces Fourth Quarter and Fiscal Year 2023 Results – Procter & Gamble

P&G Announces Fourth Quarter and Fiscal Year 2023 Results.

Posted: Fri, 28 Jul 2023 11:20:24 GMT [source]

Also, depending on the type and nature of a non-current asset, it can be – depleted, depreciated, or amortised. Recall that equity can also be referred to as net worth—the value of the organization. The concept of equity does not change depending on the legal structure of the business (sole proprietorship, partnership, and corporation). The terminology does, however, change slightly based on the type of entity.

But noncurrent assets may likewise include intangible items, such as intellectual properties like design patents. Such items’ useful lives typically exceed one fiscal year and are unlikely to be liquidated within that time frame. Instead, patents take an amortization approach, where their costs are spread out over their useful lives, which can span many years—even decades. Noncurrent assets describe a company’s long-term investments/assets, such as real estate property holdings, manufacturing plants, and equipment. These items have useful lives that minimally span one year, and are often highly illiquid, meaning they cannot easily be converted into cash.

What Are Examples of Current Assets and Noncurrent Assets?

These assets, regardless of the type, serve the company for more than a year. Noncurrent assets are typically valued at their cost price minus any accumulated depreciation. For intangible assets like goodwill, they are valued based on the amount a company is willing to pay for it in a business combination. Like amortization, depreciation is an accounting method where the cost of a tangible asset is likewise spread out over the course of its useful life. For this reason, a rule created by the International Accounting Standards Board mandates that the depreciation of a noncurrent asset must be itemized as an expense on a company’s financial statements.

- Investors and creditors use numerous financial ratios to assess liquidity risk and leverage.

- An asset is any item or resource with a monetary value that a business owns.

- Noncurrent assets are usually categorized into tangible and intangible assets.

- In the case of a student loan, there may be a liability with no corresponding asset (yet).

- Current assets are vital sources of money to meet the liquidity needs of a company.

- Noncurrent assets play a significant role in a company’s financial health and operations, they form the basis for long-term financial sustainability and growth.

Recall, too, that revenues (inflows as a result of providing goods and services) increase the value of the organization. So, every dollar of revenue an organization generates increases the overall value of the organization. It may be helpful to think of the accounting equation from a “sources and claims” perspective.

Which is the best model of computing for noncurrent assets?

A business can purchase or otherwise acquire an intangible asset from outside of the business. Any asset created by the business won’t have a measurable value, as it’s unique to the business itself and lack of market value for evaluation. If the financial value is not measurable, it can’t be recorded on the balance sheet per accounting standards. Under most accounting frameworks, including both US GAAP and IFRS, Investments are generally held at purchase price (known as book value) on a company’s balance sheet.

Dentsply Sirona Reports Second Quarter 2023 Results – EIN … – EIN News

Dentsply Sirona Reports Second Quarter 2023 Results – EIN ….

Posted: Wed, 02 Aug 2023 20:30:00 GMT [source]

Based on ease of convertibility into cash, business assets can be further classified into current and non-current assets. In this article, we talk about non-current assets, their types, how to calculate them, and a few examples to help you understand better. At the time of mergers and acquisitions, these invisible assets are valued using several methods and are shown in the balance sheet under the heading intangible assets. The intangible assets so acquired are amortized over their useful life, using an amortization method. Non-current assets can be both “tangible” and “intangible”, that is, things you can physically see and touch as well as resources that do not have a physical form.

Introduction of Non-Current Assets

Investments are classified as noncurrent only if they are not expected to turn into unrestricted cash within the next 12 months of the balance sheet date. Property, plant, and equipment—which may also be called fixed assets—encompass land, buildings, and machinery (including vehicles). Current assets are vital sources of money to meet the liquidity needs of a company. For example, a company could pay suppliers immediately or pay off short-term debt with cash. The format of this illustration is also intended to introduce you to a concept you will learn more about in your study of accounting.

While a high proportion of noncurrent assets to current assets may indicate poor liquidity, this may also simply be a function of the respective company’s industry. Examples of noncurrent assets include notes receivable (notice notes receivable can be either current or noncurrent), land, buildings, equipment, and vehicles. An example of a noncurrent liability is notes payable (notice notes payable can be either current or noncurrent). A noncurrent asset is an asset that is not expected to be consumed within one year. Some noncurrent assets, such as land, may theoretically have unlimited useful lives. A noncurrent asset is recorded as an asset when acquired, rather than being charged to expense.

All this information comes in handy for a company’s management and helps them to plan their investment in company assets more effectively. Let’s continue our exploration of the accounting equation, focusing on the equity component, in particular. It is helpful to also think of net worth as the value of the organization.

This value could come in the form of customer lists, brand recognition, intellectual property, or even projected cost savings (often referred to as “synergies”). These represent Exxon’s long-term investments like oil rigs and production facilities that come under property, plant, and equipment (PP&E). Fixed assets include property, plant, and equipment because they are tangible, meaning that they are physical in nature; we may touch them. For example, an auto manufacturer’s production facility would be labeled a noncurrent asset. Current assets are generally reported on the balance sheet at their current or market price. It helps the management of a company along with investors to determine the proficiency of a firm to use resources and generate earnings.

Furthermore, such assets are reported in the company’s balance sheet and are generally placed under the header of PP&E, intellectual property, investment, intangible assets, or other long-term assets. Intangible assets are items that represent value to a company within the context of its business operations. These non-current assets generate revenue or benefits for the business into future fiscal periods, but they do not have any physical substance (like PP&E would, for example). At this point, let’s take a break and explore why the distinction between current and noncurrent assets and liabilities matters. It is a good question because, on the surface, it does not seem to be important to make such a distinction. But we have to dig a little deeper and remind ourselves that stakeholders are using this information to make decisions.

Using the revaluation model, the total revaluation gain on March 31, 2022, will be Rs 90,000 (7,10,000 – 6,20,000). Of this, the revaluation gains recognised in the Income statement will be Rs 80,000 and the revaluation surplus of Rs 10,000 will be recognised in shareholder’s equity. That’s followed closely by money that you can withdraw from your business’s bank account. A business asset is any item or resource that your business owns, has a monetary value, and helps the business function. Assets differ from business to business depending on what those businesses do, how they operate, and their position in the supply chain.

A quick summation of all the factors on the non-current assets list will help to ascertain the total value of the same for a company in a given period. Four key elements are factored in to compute the value of non-current assets. These are – original worth, depreciation amount, revaluation, and disposable value of assets in question. These assets do not have any physical form but are considered to be of economic value to a company.

Recent Comments